Temporary Shift Schedule To Align Work Hours Computation

A temporary work schedule is a short-term adjustment to an employee’s regular working hours, often implemented to meet specific operational needs, project deadlines, or unforeseen circumstances. In the context of the timekeeping process, aligning these temporary schedules with accurate hours computation ensures that employee attendance, overtime, and pay are correctly recorded and processed during the period of the adjustment.

Key Element

-

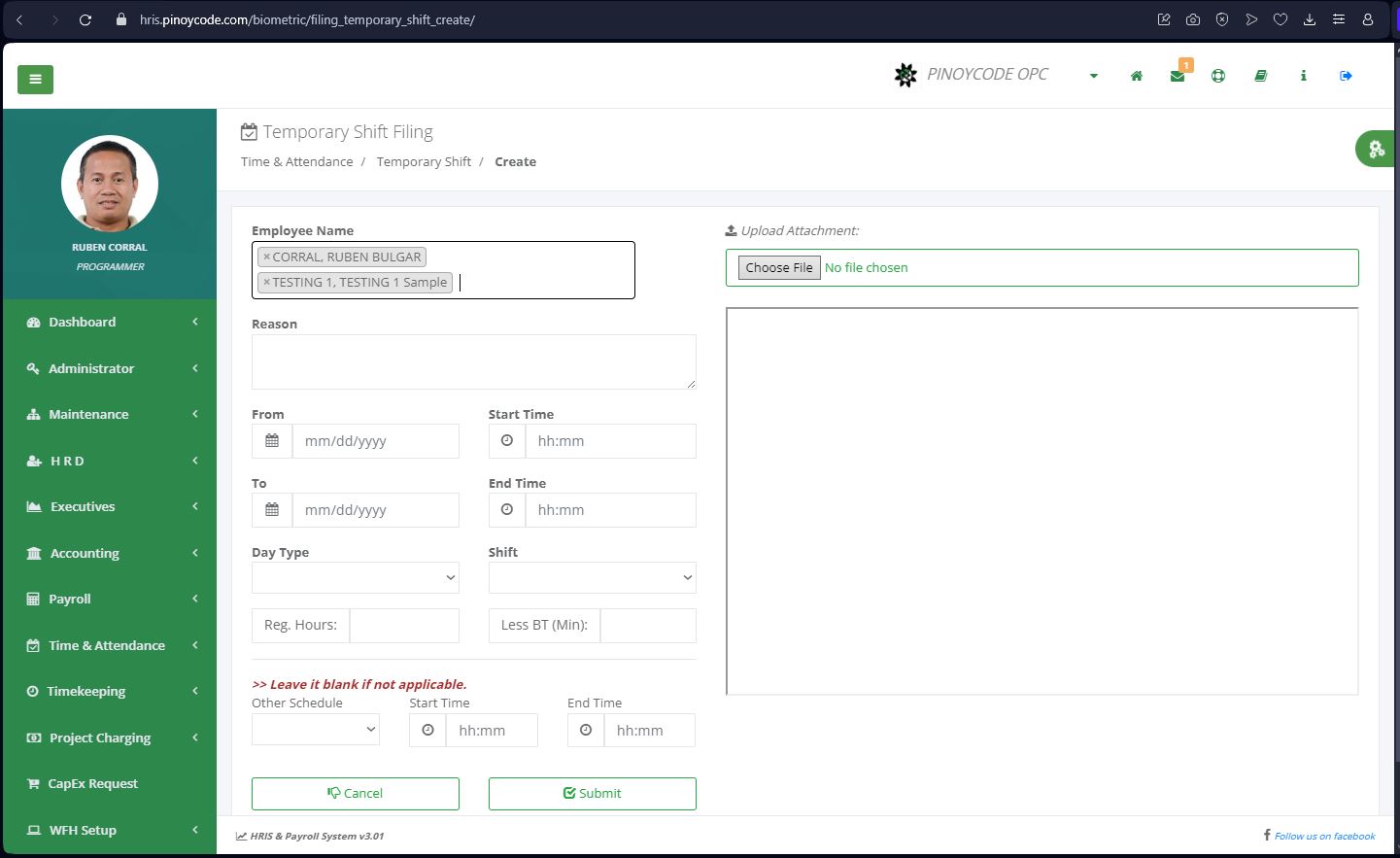

Establishing the Temporary Work Schedule:

- The temporary work schedule is typically defined by the department or team based on operational requirements, such as workload spikes, project needs, or external factors (e.g., holidays or temporary office closures).

- The new schedule may involve changes in start/end times, number of work hours per day/week, or even different work patterns (e.g., compressed workweeks or flexible hours).

- For instance, an employee may be asked to work extra hours for a short period or shift their hours temporarily to accommodate urgent business demands.

-

Communication and Approval:

- The temporary schedule is communicated to employees in advance to allow them to plan accordingly. In many cases, the change requires approval from HR or management to ensure alignment with company policies and compliance with labor laws.

- Employees are made aware of how the temporary schedule will affect their work hours, including any implications for overtime, breaks, or shift differentials.

-

Timekeeping and Hours Computation:

During the period of a temporary work schedule, timekeeping systems need to be adjusted to account for the non-standard hours worked. This can include:

- Tracking adjusted hours: The system records the specific hours worked each day, whether they are regular hours, overtime, or hours worked outside the usual shift times.

- Overtime Calculations: If the temporary schedule results in overtime (e.g., working beyond the typical 40 hours a week), the timekeeping system ensures that overtime is accurately computed based on company policies (e.g., time-and-a-half or double time).

- Absence or Leave Management: If the employee is given more flexibility in their hours or a different workweek, the timekeeping system adjusts for any leave taken or non-working hours, ensuring the payroll is accurate.

-

Integration with Payroll:

- The temporary work schedule’s impact on hours worked is crucial for accurate payroll processing. Payroll systems integrate with the timekeeping process to compute compensation based on the adjusted hours, including any overtime or shift differentials.

- If temporary changes involve a reduction in hours or altered pay rates (e.g., fewer work hours or non-standard pay rates), the payroll system must reflect these variations.

-

Compliance and Legal Considerations:

- Labor Law Compliance: Employers must ensure that temporary schedule changes comply with labor laws, including regulations on maximum working hours, overtime, and rest periods.

- Employee Contractual Agreements: If the temporary schedule deviates from what is outlined in the employee’s contract, the company may need to renegotiate or provide written consent for the change.

-

Monitoring and Reporting:

- The organization monitors the temporary schedule's effectiveness and its impact on productivity, employee engagement, and compliance with regulations.

- Timekeeping systems generate reports to help track the accuracy of hours worked and flag any discrepancies that may require further investigation.

Benefits:

- Flexibility: Temporary schedules allow organizations to adapt quickly to changing business needs, such as increased workload or unforeseen events.

- Accurate Compensation: Adjusting the timekeeping process ensures that employees are fairly compensated for the actual hours worked, including overtime or non-standard hours.

- Improved Productivity: By adjusting work schedules, businesses can optimize employee availability to meet critical deadlines or project goals.

Challenges:

- Employee Disruption: Frequent changes to work schedules can cause confusion or dissatisfaction among employees, especially if not communicated clearly.

- Administrative Complexity: Managing temporary schedules requires careful coordination between HR, timekeeping, and payroll systems, which can become complex for large teams or frequent schedule changes.

- Overtime Costs: Extended or irregular hours could result in higher payroll costs due to overtime, impacting the organization’s budget.

Optimization:

- Many companies use automated timekeeping software to adjust and manage temporary schedules efficiently. These systems track and compute hours worked in real-time, reducing manual errors and streamlining payroll processing.

- Clear communication tools (e.g., internal HR portals or employee apps) can help employees stay informed about temporary schedule changes.

In summary, a temporary work schedule that aligns with hours computation in the timekeeping process ensures that employees’ adjusted hours are accurately tracked and compensated. It provides flexibility for organizations while maintaining fairness and compliance with labor laws, leading to smooth payroll processing and employee satisfaction.

ULTRA LOTTO 6/58

- Draw Date: 07/01/2025

- Result: 34-24-41-48-37-36

- Price: Php 173,307,289.20

- Winner: 0

GRAND LOTTO 6/55

- Draw Date: 07/02/2025

- Result: 11-29-13-48-20-09

- Price: Php 29,700,000.00

- Winner: 0

SUPER LOTTO 6/49

- Draw Date: 07/03/2025

- Result: 27-42-48-46-45-44

- Price: Php 15,840,000.00

- Winner: 0

MEGA LOTTO 6/45

- Draw Date: 07/02/2025

- Result: 38-07-16-44-15-42

- Price: Php 46,134,409.20

- Winner: 1

LOTTO 6/42

- Draw Date: 07/03/2025

- Result: 34-02-17-35-20-05

- Price: Php 20,386,720.80

- Winner: 0

6 Digit

- Draw Date: 07/03/2025

- Result: 0-0-2-4-3-8

- Price: Php 493,474.00

- Winner: 1

4 Digit

- Draw Date: 07/02/2025

- Result: 8-2-2-3

- Price: Php 21,974.00

- Winner: 24

SWERTRES RESULTS

- Draw Date: 07/03/2025

- 2PM: 8-6-5

- 5PM: 8-5-9

- 9PM: 9-9-9

EZ2 RESULTS

- Draw Date: 07/03/2025

- 2PM: 28-03

- 5PM: 10-21

- 9PM: 14-29